Retirement Plan Comparison Chart 2025

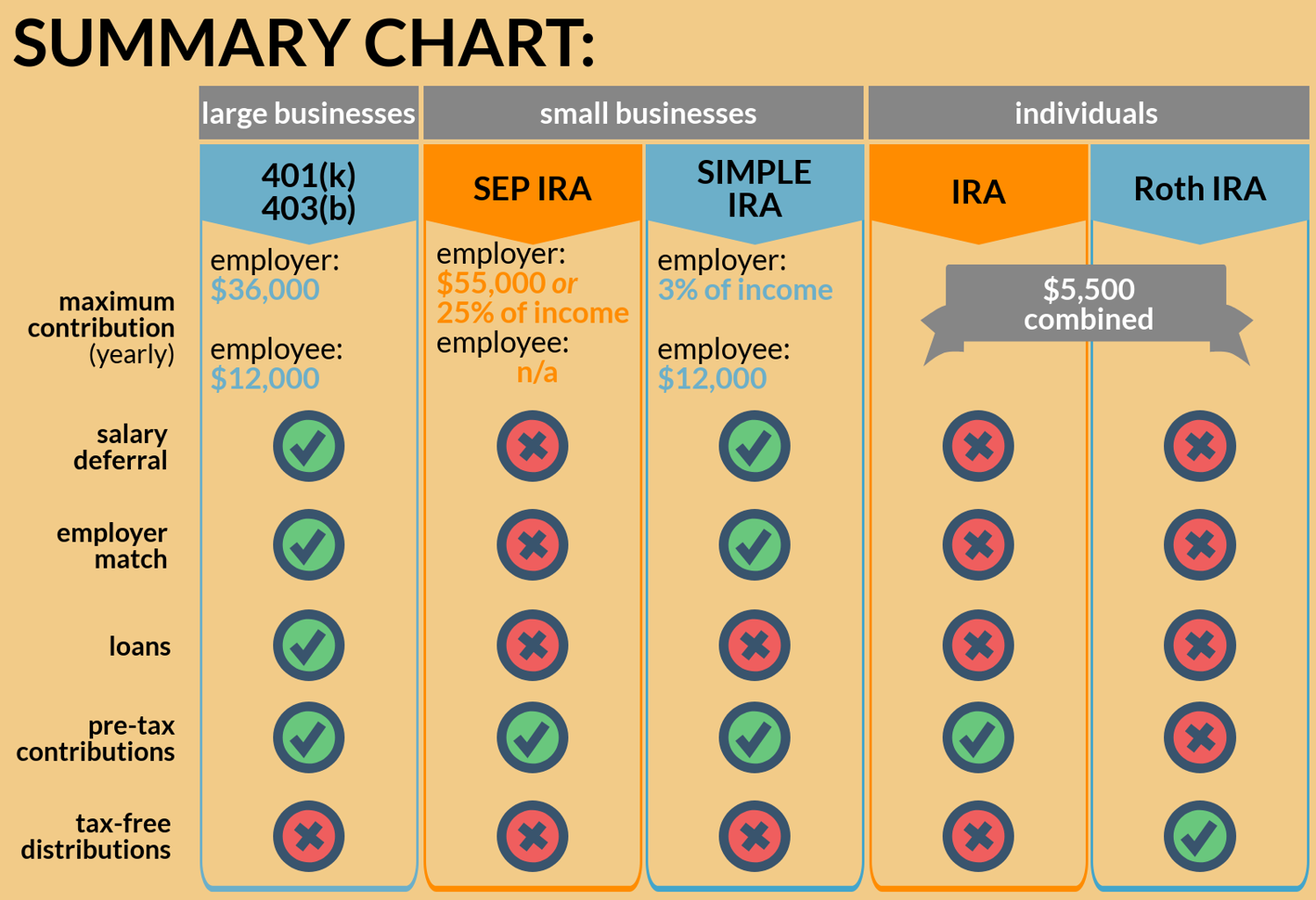

Retirement Plan Comparison Chart 2025. From 401(k)s to individual retirement accounts (iras) to retirement plans for business owners, we compiled a list of the various retirement accounts to examine. $23,000 per year (2025), or 100% of compensation, whichever is less.

2025 retirement plan contribution limits. The overall contribution limit is $69,000 plus any applicable.

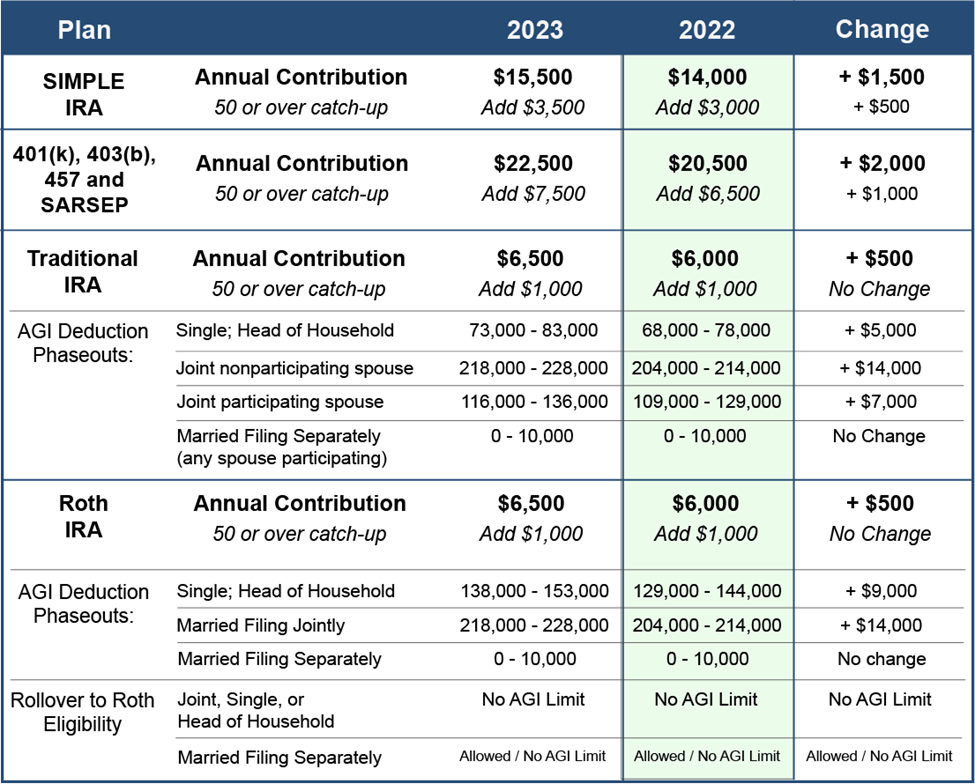

Retirement Plan Comparison Chart Cain Advisory Group, The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if. Traditional 403(b) roth 403(b) 457(b) contributions.

Retirement Plan Comparison Chart, 2025 retirement plan contribution limits. Very similar to a 401(k), plan holders can.

Retirement Planning Understanding the Most Popular Workplace, 7 best retirement plans compared in 2025 (+ pros & cons) what are the best retirement plans of 2025? The maximum amount you can contribute to a traditional ira or a roth ira in 2025 will be $7,000 (or 100% of your earned income, if.

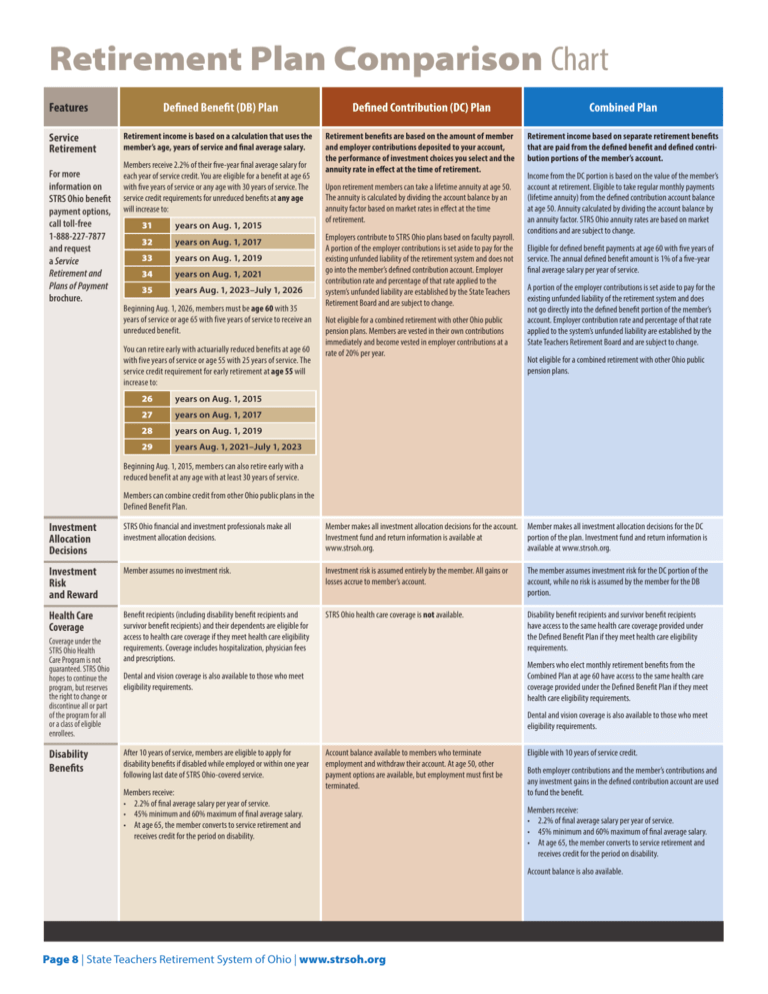

Retirement plan types comparison chart Early Retirement, What is a pension plan? The changes are phased in over.

Plan Your Retirement Savings Goals for 2025 Integrated Tax Services, For 2025, those ceilings are $7,000 for a traditional ira. In 2025, the most you can contribute to all of your iras (traditional and roth combined) is $7,000.

Retirement Contribution Limits Financial Journey Partners in San Jose, In 2025, trump proposed a. Retirement plans comparison chart 2025.

Retirement plan types comparison chart Early Retirement, All the essential things you need to know about. 2025 plan comparison charts and sbc;

Retirement Plan Types Comparison Chart My XXX Hot Girl, Retirement plan comparison chart | 2025 1 compensation is limited to $345,000 per year. *includes roth 401(k) not deposits • not insured by fdic or any other government agency • not guaranteed by the bank • subject to risk and may lose value.

New IRS Indexed Limits for 2025 Aegis Retirement Aegis Retirement, Employees who are age 50 and older can defer an additional $7,500. All the essential things you need to know about.

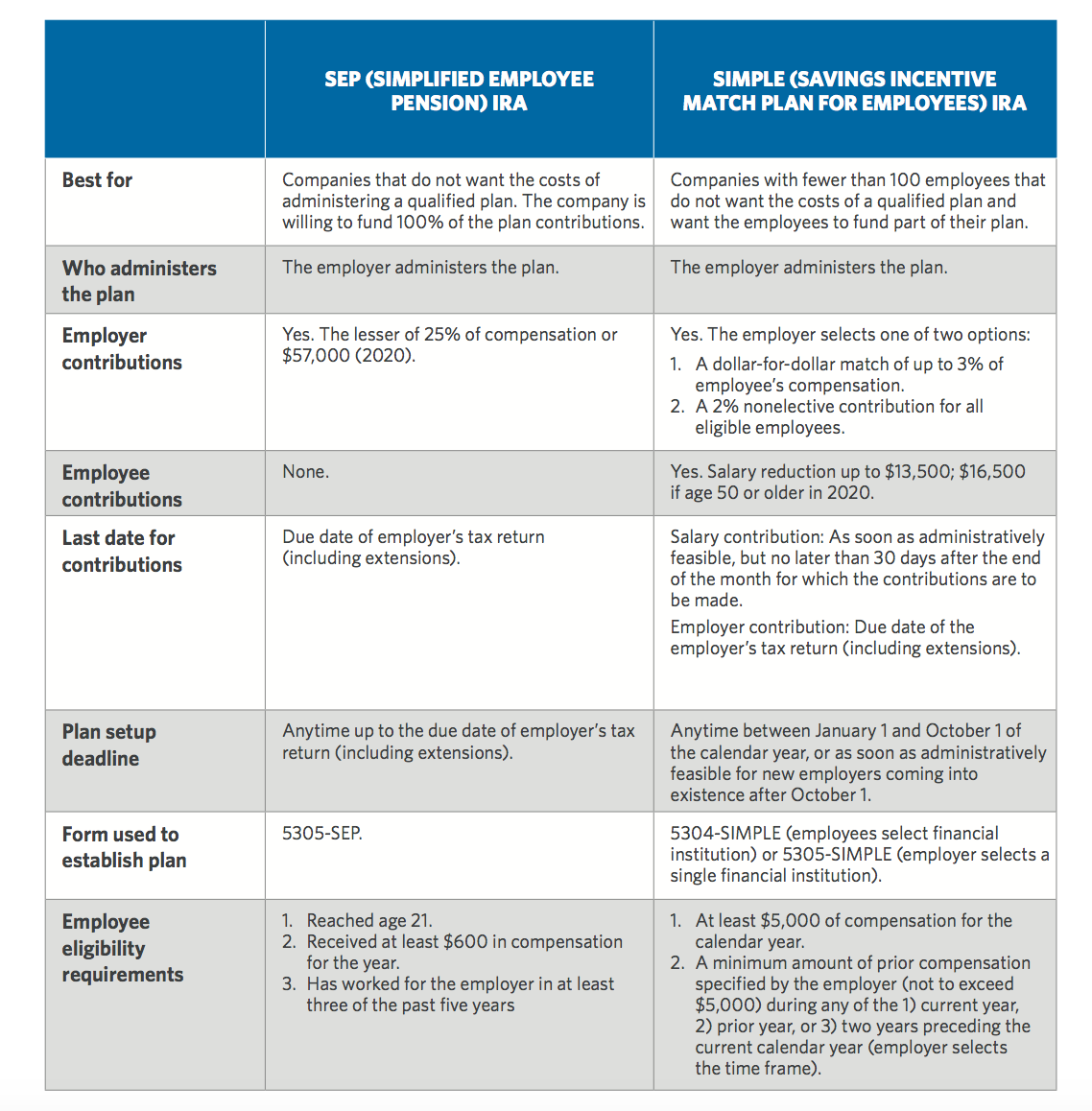

Guidance for Business Owners Selecting a Retirement Plan Jones & Roth, Simplified employee plan (sep) is a retirement plan that’s established by an employer. 2025 plan comparison charts and sbc;